Discover TWEX®

TWEX® provides a platform for Web3 applications with a set of easy configurable templates and services. Several solutions are already live.

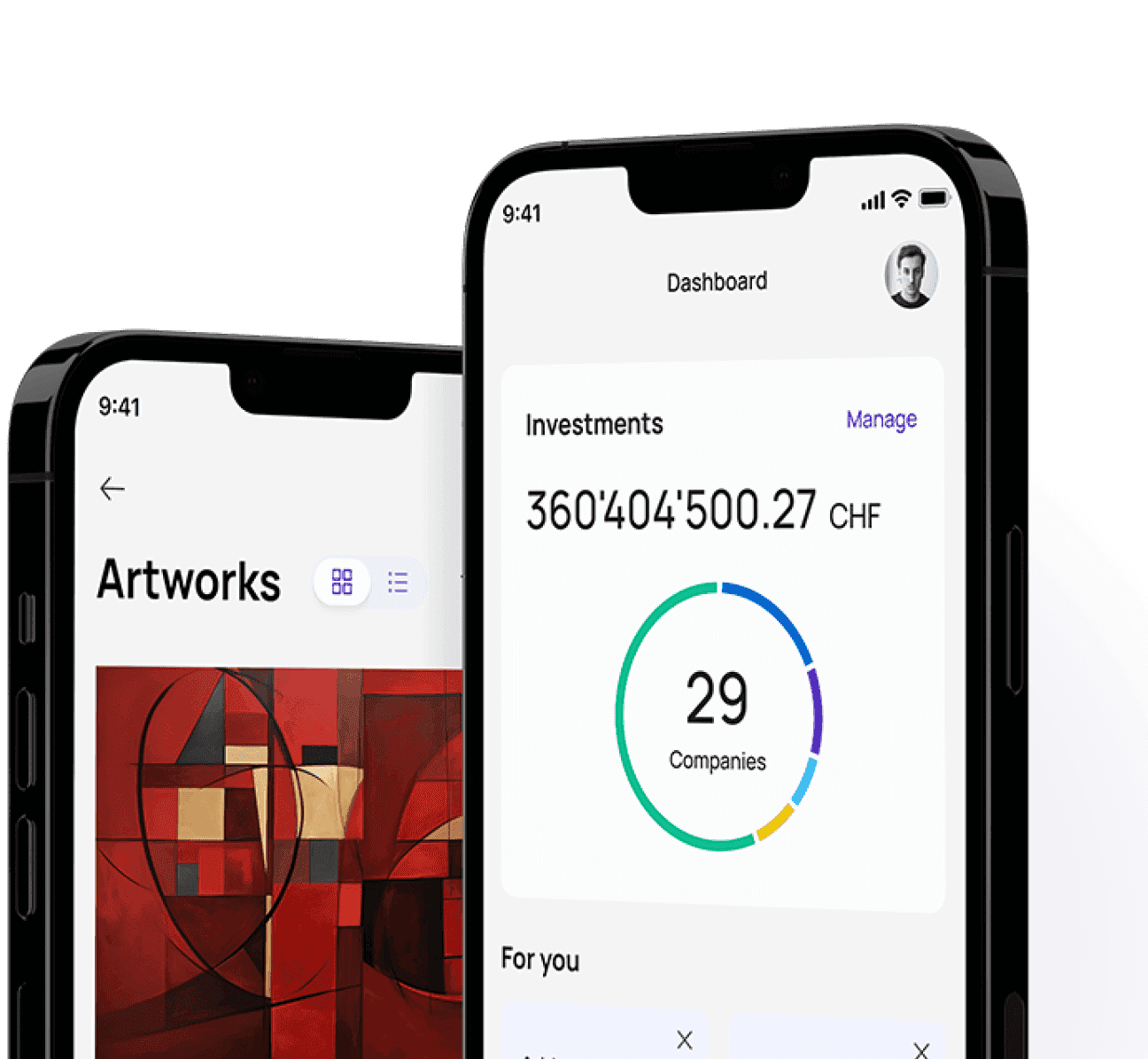

Tokenisation & Governance

Financial Instruments, Artworks, Intellectual Property

![A set of images representing smart payments]()

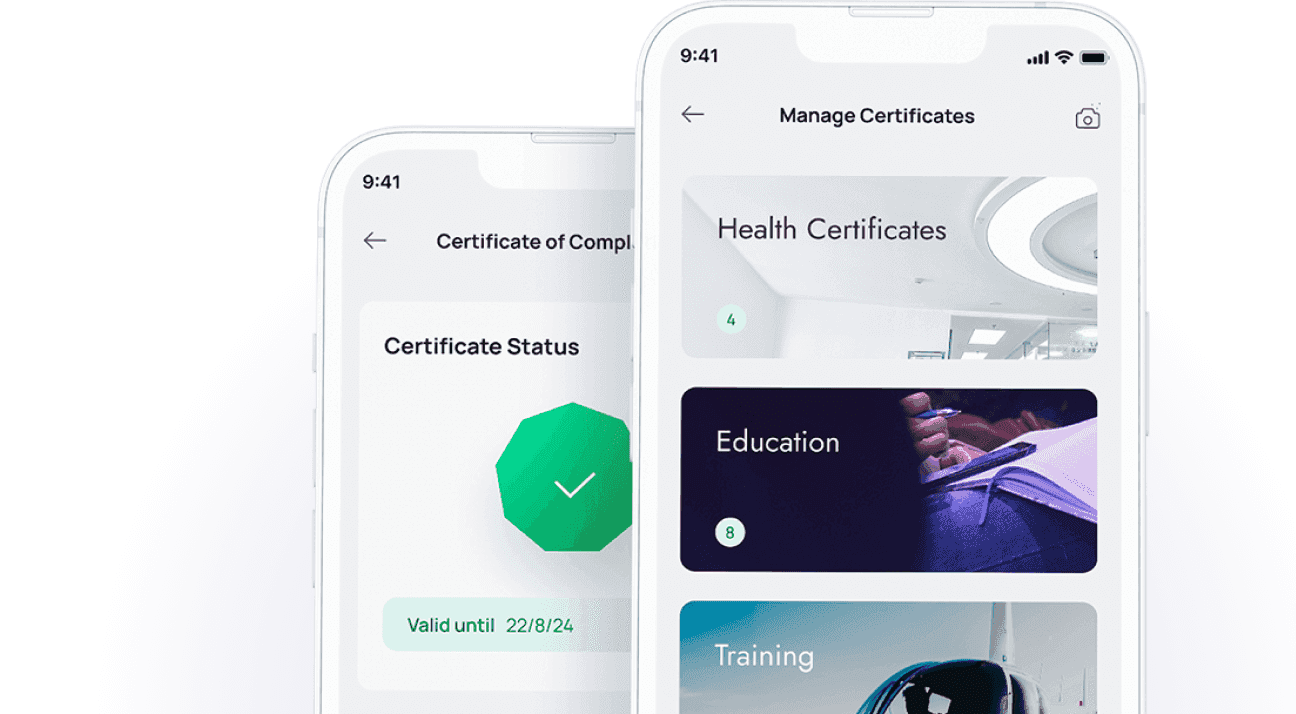

![Two smartphones showing interactions between users of certificates]()

Partner With Us

Use TWEX® to offer individual professional services such as corporate housekeeping, digital asset custody, or artworks curation services to your clients. Build your own blockchain solutions on the TWEX® Platform. Integrate blockchain services into your applications.